The much anticipated 2008 year-end Berkshire Hathaway Shareholders’ letter was released today. Buffett’s words are followed both for information on the direction of the conglomerate (highly weighted in insurance and utilities), as well as his thoughts and criticism of both business and politics.

It’s tone, wit, and substance is eaten up by media outlets. Stories are released within two hours after digesting the 20 page later. The headlines, of course, say a lot about how his words are interpreted, what the company’s results mean, and how this bodes for the economy as a whole.

So, I present to you how the most highly-regarded media sources and their spin on what he said. This does not substitute actually reading it, something I would encourage to anyone who either owns stocks or cares about politics or economics.

Here they are:

AP: Berkshire reports a 96 percent drop in 4Q profit

NYT: In Letter, Buffett Is Frank but Optimistic

WSJ: Berkshire Reports Worst Year Ever

Bloomberg 1: Buffett Says U.S. Economy Will Be `Shambles' in 2009, Likely `Well Beyond'

Bloomberg 2: Berkshire Profit Plunges 96% as Buffett Writes Down Derivatives Positions

Reuters: Berkshire net sinks; Buffett says economy in shambles

FT: Buffett’s Berkshire has worst results ever

I would have to cast my vote for the New York Times article, both for the headline and for its content.

As a Buffett devotee, I copied quotes and have lumped them together in this little collage:

“

be in shambles throughout 2009 – and, for that matter, probably well beyond…

Home purchases should involve an honest-to-God down payment

of at least 10% and monthly payments that can be comfortably handled by the borrower’s income. That income should be carefully verified... The investment world has gone from underpricing risk to overpricing it…The U.S. Treasury bond bubble of late 2008 may be regarded as almost equally extraordinary.”

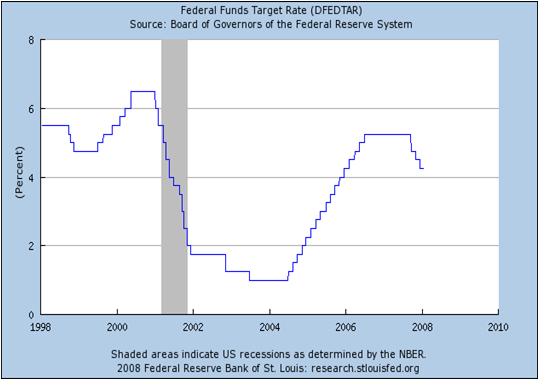

What does this mean? The last two parts of the quotes are crucial for the individual investor. Buffett is predicting inflation; Bernanke is a scholar of the Great Depression and knows the perils of deflation. Inflation is currently not on the market’s mind, but as money is injected into the system prices and interest rates will rise—a death blow to bonds (prices and interest rates are inversely correlated). But, short-term bonds (little interest rate risk) in high quality corporations will do well—the “overpricing” of risk that he mentions means that some bonds are cheap. That’s why he’s pounced on fixed income in GE, Wrigley, Goldman, Harley Davidson, Tiffany, and others.

We’d be smart to look for similar bargains in high-quality companies’ debt.

JA